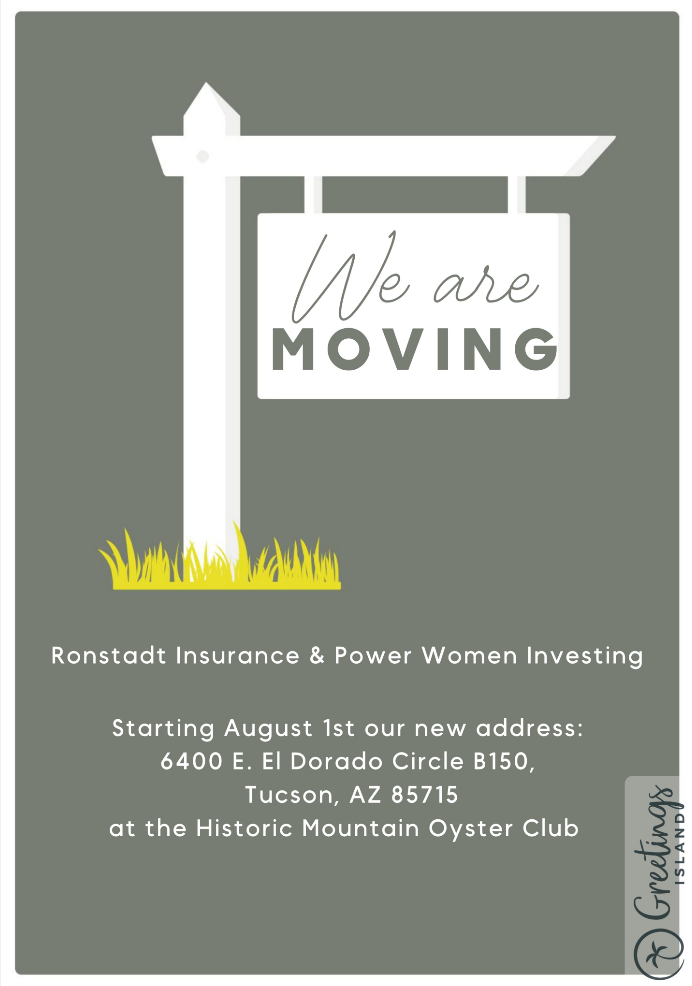

We are Moving our Office!

On July 4, 2025, President Donald Trump signed the One Big Beautiful Bill Act (OBBB Act) into law. This major legislation includes a variety of updates to employee benefit plans — most of which take effect in 2026.

🖥️ Telehealth Just Got Easier

HDHPs can permanently cover telehealth and remote care before deductibles — without affecting HSA eligibility.

💳 HSA Expansion

Starting in 2026:

👶 Bigger Dependent Care FSA Limits

Starting in 2026:

🎓 Student Loan Repayment Help = Permanent

Employers can keep helping pay student loans through educational assistance programs beyond 2025.

🍼 Introducing “Trump Accounts” for Kids

A new tax-advantaged savings account for children under 18:

Have any more questions? Give us a call at 520-721-4848

📅June 27, 2025 — In a landmark decision, the U.S. Supreme Court upheld a central provision of the Affordable Care Act (ACA), affirming that health plans and issuers must continue covering the full range of recommended preventive care services without cost sharing.

⚖️ The Case: Kennedy v. Braidwood Management, Inc.

The ruling reverses a previous decision by the 5th Circuit Court and affirms that the ACA’s preventive care mandate is constitutional. As a result, health plans and issuers must continue offering free preventive services—including immunizations and screenings—as long as they’re provided by in-network providers.

💡 Reminder: These services must be offered without deductibles, copayments, or coinsurance.

🩺 What’s Included in Preventive Care Coverage?

Under the ACA, non-grandfathered health plans are required to cover: